How U.S. Cities Address Affordable Housing: A Nationwide Analysis

Using City Council Data to Reveal Trends, Tools, and Tactics in Affordable Housing Policy

Created: December 20, 2024 · 7 min read

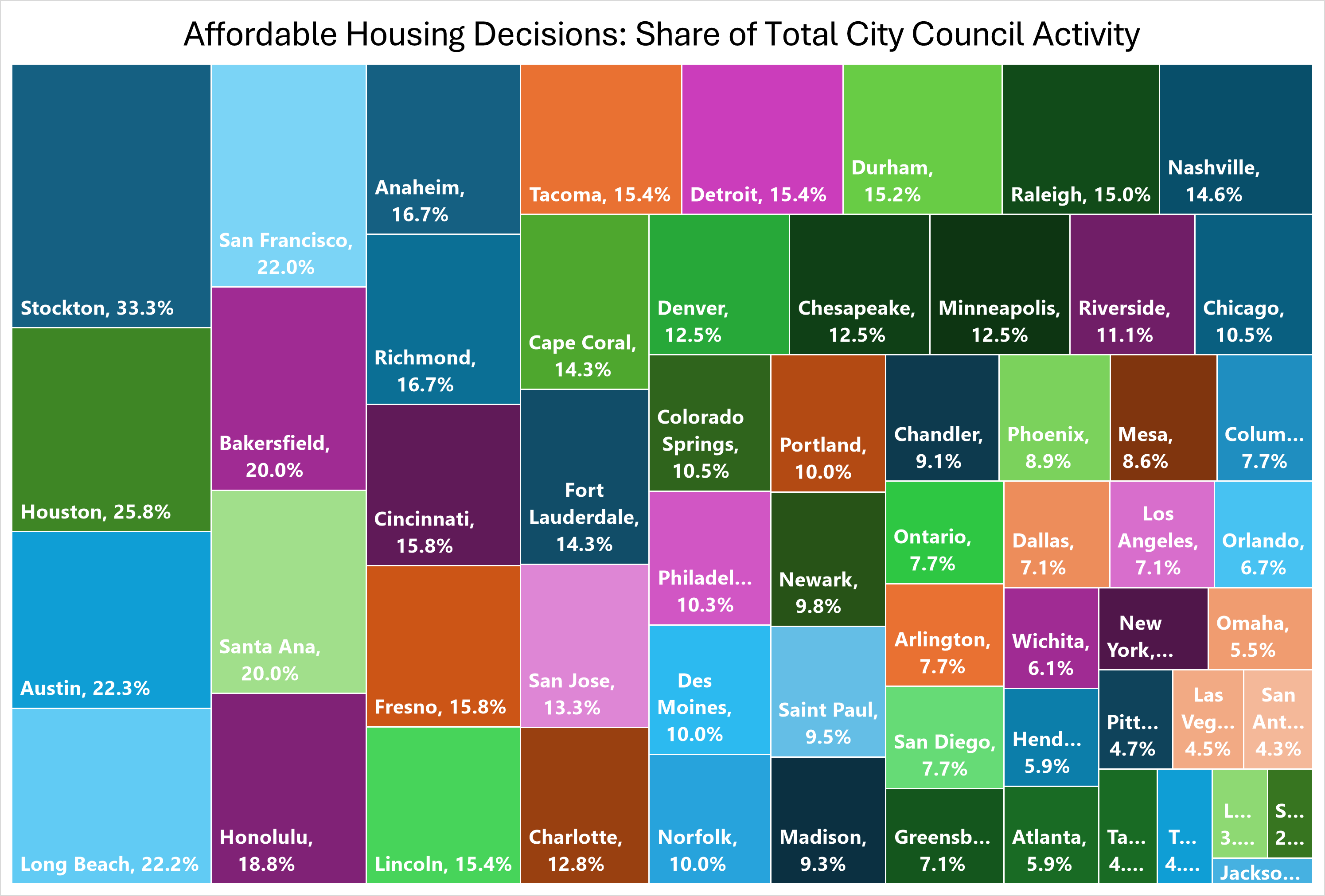

At ReZone, we track real estate-related city decisions nationwide, categorizing them into 12 major areas. Today we focus on the first out of the 12 categories - affordable housing. There’s lots of talk about infamous affordability initiatives - like Section 8, or LIHTC - but what is happening on the ground day in and day out? Our goal is to understand the types of decisions being passed in America’s largest cities and to identify similarities & differences.

Affordable housing is a widely discussed topic, but it’s challenging to define. Most agree that Section 8, LIHTC, and public housing count towards affordable housing, but how about workforce housing, ADUs, and coliving concepts? Brad Hargreaves has written a great piece discussing different affordability business models, which we will use as our basis.

Types of Decisions

At ReZone, we categorize affordable housing broadly. For instance, if a rezoning includes an affordable housing component, we classify it primarily as affordable housing, with rezoning as a secondary category. We have identified five main types of affordable housing decisions. The most common are tax exemptions.

Tax Exemptions

Payment in lieu of taxes (PILOT) agreements, property tax exemptions, and tax increment financing are widespread. Cities like Houston, New York, and Detroit often rely heavily on PILOTs, while San Francisco and Austin tend to use tax credits more frequently.

Often, tax exemptions are added to larger decisions—such as rezonings, final plats, development approvals, or loan approvals—to incentivize affordable housing.

Public-Private Financing Models

Nearly all cities use a combination of loans, bonds, grants, and local funds to support both new affordable housing construction and the preservation of existing units. Many cities also leverage federal and state programs such as HOME, CDBG, ARPA, and LIHTC. Below, we detail some commonly used but lesser-known models:

Mortgage Revenue Bonds (MRB)

MRBs are tax-exempt multifamily housing bonds used to finance the acquisition, construction, or rehabilitation of housing for low-income renters.

Developers benefit from lower mortgage rates and, in return, charge residents less. Most development agreements or loan approvals are contingent on maintaining rent below an agreed-upon AMI (which varies by region) for a fixed period. Private investors accept lower yields because their gains are exempt from federal income tax.

Home-ARP Funds

Home American Rescue Plan (Home-ARP) funds are allocated based on state and local jurisdictions. These funds must primarily benefit individuals or families who are homeless, at risk of homelessness, or fleeing violence or assault.

Funds can be used for:

- Construction or preservation of affordable housing

- Tenant-Based Rental Assistance (TBRA)

- Homelessness prevention services, housing counseling

- Purchase and development of non-congregate shelter

Housing Trust Fund (HUD)

The Housing Trust Fund (HTF), established under the Housing and Economic Recovery Act of 2008, aims to increase and preserve the supply of decent, safe, and sanitary affordable housing for extremely low-income and very low-income households, including homeless families.

Most HTF resources complement other state or local funding programs.

City Land Releases

The partial or full release of city-owned land for development is another strategy cities use to encourage affordable housing. By making previously inaccessible parcels available, developers can build new units, and the city can repurpose underutilized properties. However, conveying public land can be complex and often requires approval from multiple agencies.

Interestingly, public land releases are most common in cities with extremely high land costs (e.g., Austin) and in cities with very low land costs (e.g., Detroit), while cities with mid-range land values engage in this strategy less often.

Urban Renewal Plans

Urban Renewal Plans (URPs) play a significant role in some cities and are nonexistent in others. For example, Portland recently approved $2.83 billion in URPs to drive inclusive growth. URPs typically last around 30 years and focus on specific goals—sometimes redeveloping blighted areas, sometimes creating vibrant, affordable, and inclusive communities. Ultimately, they are designed to make the city a better place to live.

Zoning Changes / Final Plats

Many cities incorporate affordability requirements into rezoning petitions, land transfers, and the designation of special-use districts. For instance, Anaheim’s ordinance No. 6593 mandates that all new rental projects with 35 or more units must allocate a percentage of units as affordable.

Homebuyer Assistance Programs

These programs address the affordability crisis from a different angle. Instead of subsidizing developers, they subsidize qualified homebuyers directly. Applicants often must meet specific criteria, such as a certain income threshold relative to AMI or being a first-time homebuyer.

For example, Houston’s homebuyer assistance program (HbAP 2.0) provides up to $50,000 in assistance based on a household’s financial need.

Variations by Region

Western coastal cities often use complex financing stacks and prioritize long-term covenants and public land control due to high land costs and limited availability.

Midwestern and Eastern cities frequently rely on PILOTs and grants, focusing on rehabilitating existing structures.

Southern and Southwestern cities lean toward loan approvals, developer agreements, and bond issuances, facilitated by rapid population growth.

Conclusion

While the affordability crisis is widespread, cities approach it differently based on regional real estate conditions, available funding, political priorities, and community needs. Many cities are experimenting with innovative and forward-thinking policy changes.

ReZone is primarily focused on developers, investors, and real estate professionals, but if you are a policy maker, researcher, or academic and would like to analyze our data, we would love to connect.

Daniel Heller

[email protected]